The taxpayer then needs to pay the higher of the two. This parallel tax income system requires high-income taxpayers to calculate their tax bill twice: once under the ordinary income tax system and again under the AMT.

The Alternative Minimum Tax (AMT) was created in the 1960s to prevent high-income taxpayers from avoiding the individual income tax. The personal exemption for 2023 remains at $0 (eliminating the personal exemption was part of the Tax Cuts and Jobs Act of 2017 (TCJA). The standard deduction will increase by $900 for single filers and by $1,800 for joint filers (Table 2).

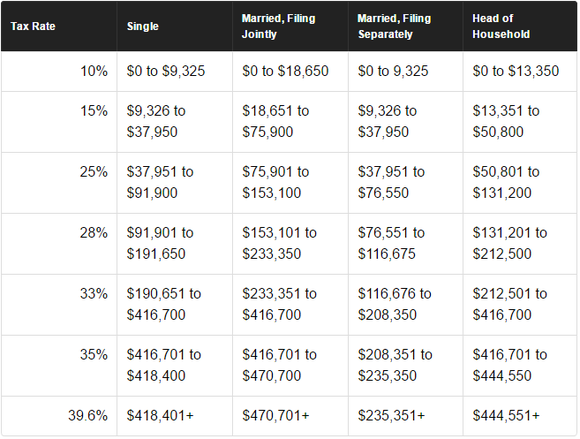

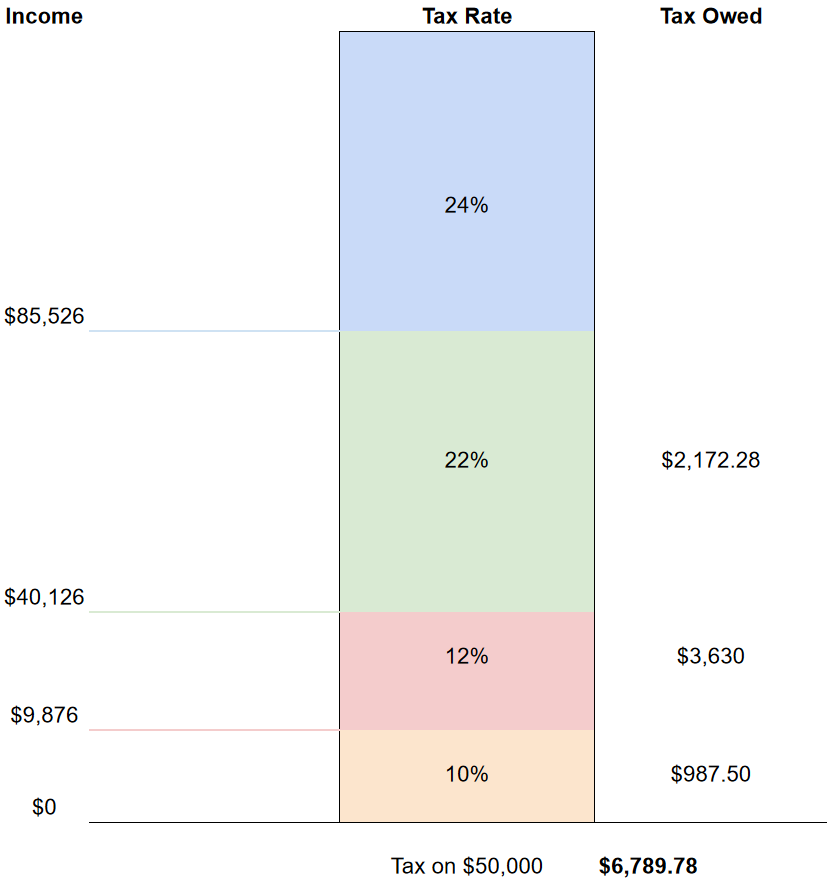

Take Survey Standard Deduction and Personal Exemption Please take our quick, anonymous survey, conducted in partnership with the University of North Carolina Tax Center. Help Us Learn More About How Americans Understand Their Taxes 2023 Federal Income Tax Brackets and Rates for Single Filers, Married Couples Filing Jointly, and Heads of Households Tax Rateįor Married Individuals Filing Joint Returns The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $693,750 for married couples filing jointly. There are seven federal income tax rates in 2023: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. In 2023, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Table 1). Note that the Tax Foundation is a 501(c)(3) educational nonprofit and cannot answer specific questions about your tax situation or assist in the tax filing process. The new inflation adjustments are for tax year 2023, for which taxpayers will file tax returns in early 2024. The IRS used to use the Consumer Price Index (CPI) as a measure of inflation prior to 2018. However, with the Tax Cuts and Jobs Act of 2017 (TCJA), the IRS now uses the Chained Consumer Price Index (C-CPI) to adjust income thresholds, deduction amounts, and credit values accordingly. On a yearly basis the Internal Revenue Service (IRS) adjusts more than 60 tax provisions for inflation to prevent what is called “ bracket creep.” Bracket creep occurs when people are pushed into higher income tax brackets or have reduced value from credits and deductions due to inflation, instead of any increase in real income.

0 kommentar(er)

0 kommentar(er)